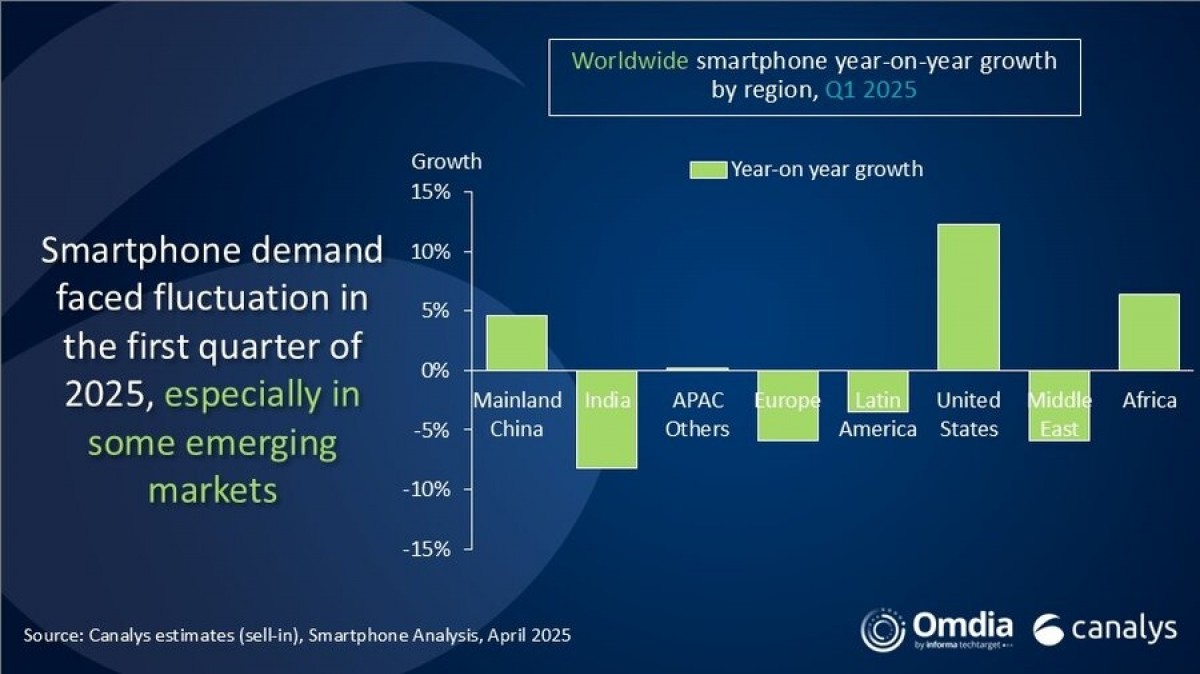

Canalys posted its latest research on global smartphone shipments. The report said 296.9 million units were moved in Q1 2025, just 0.2% up from the same period last year. Markets like Mainland China and the United States saw a healthy increase, which was offset by India, Europe, and the Middle East, where consumers approached the market cautiously.

The decline in India, Latin America, and the Middle East indicated a saturation in replacement demand. Although these regions saw an increase during the previous quarter, users are now more reluctant to purchase a smartphone.

Europe, on the other hand, is facing a high inventory after plenty of shipments in 2024, ahead of the upcoming eco-design directive. The EU demands that all phone manufacturers offer easily repairable devices and multiple years of software support, but this will apply to devices imported later in 2025.

Africa saw “vibrant retail activities” and “proactive market expansion efforts” from all manufacturers. Companies like vivo and Honor saw a double-digit growth in their overseas markets, with Honor reaching a historic high.

The situation with the United States is also curious. Manufacturers, especially Apple, shipped many phones ahead of the “Liberation Day” tariffs to try to avoid the financial cost. However, the issue will disproportionately affect lower-cost models, driving ASP higher but causing both consumers and manufacturers to struggle.

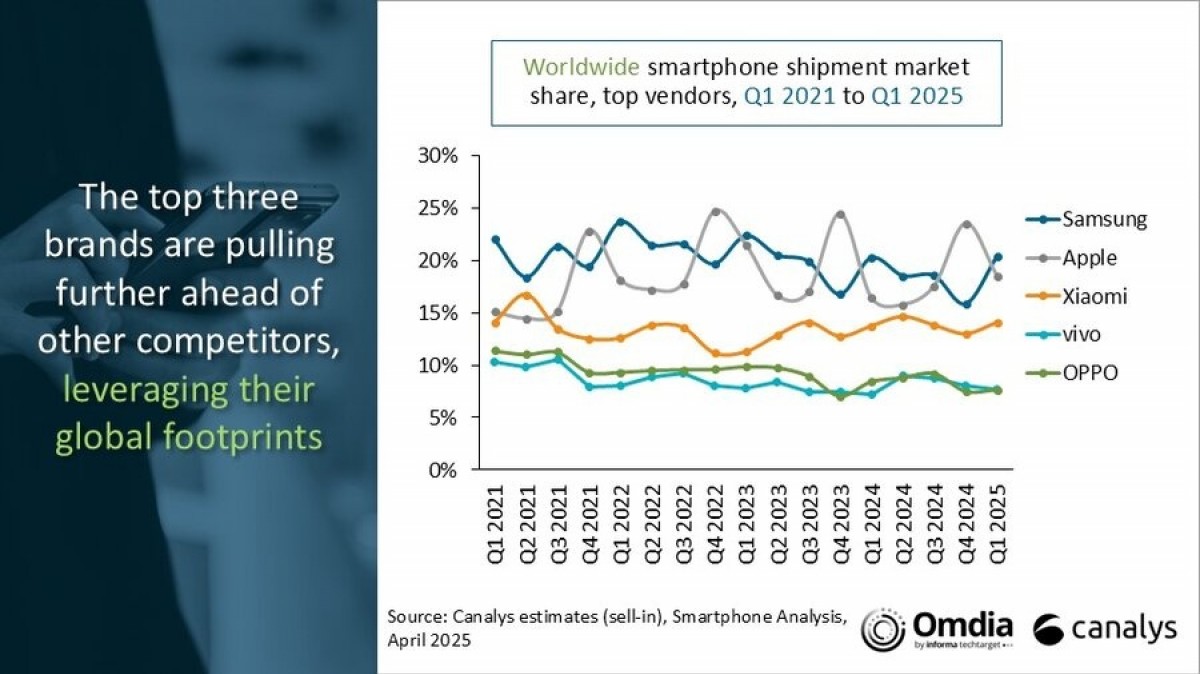

Looking at companies, Samsung kept its lead with 20% market share, closely followed by Apple with 19%, mostly due to stockpiling in March. Xiaomi remained in third with 14%, with vivo and Oppo rounding up the Top 5.

| Q1 2025 (shipments in million) |

Q1 2025 Market share |

Q1 2024 (shipments in million) |

Q1 2024 Market share |

Annual change | |

| Samsung | 60.5 | 20% | 60.0 | 20% | 1% |

| Apple | 55.0 | 19% | 48.7 | 16% | 13% |

| Xiaomi | 41.8 | 14% | 40.7 | 14% | 3% |

| vivo | 22.9 | 8% | 21.4 | 7% | 7% |

| Oppo | 22.7 | 8% | 25.0 | 8% | -9% |

| Others | 94.0 | 32% | 100.5 | 34% | -6% |

| Total | 296.9 | 100% | 296.2 | 100% | 0% |

Canalys pointed out that major brands remain “optimistic” about a market rebound in Q2. Decreasing inventory levels and new product launches should boost market performance, but competition in the mid-range segment ($200-$400) is becoming tight.

Escalating global trade tensions might also drive countries to pursue localized smartphone manufacturing, requiring additional investments and cost pressures.