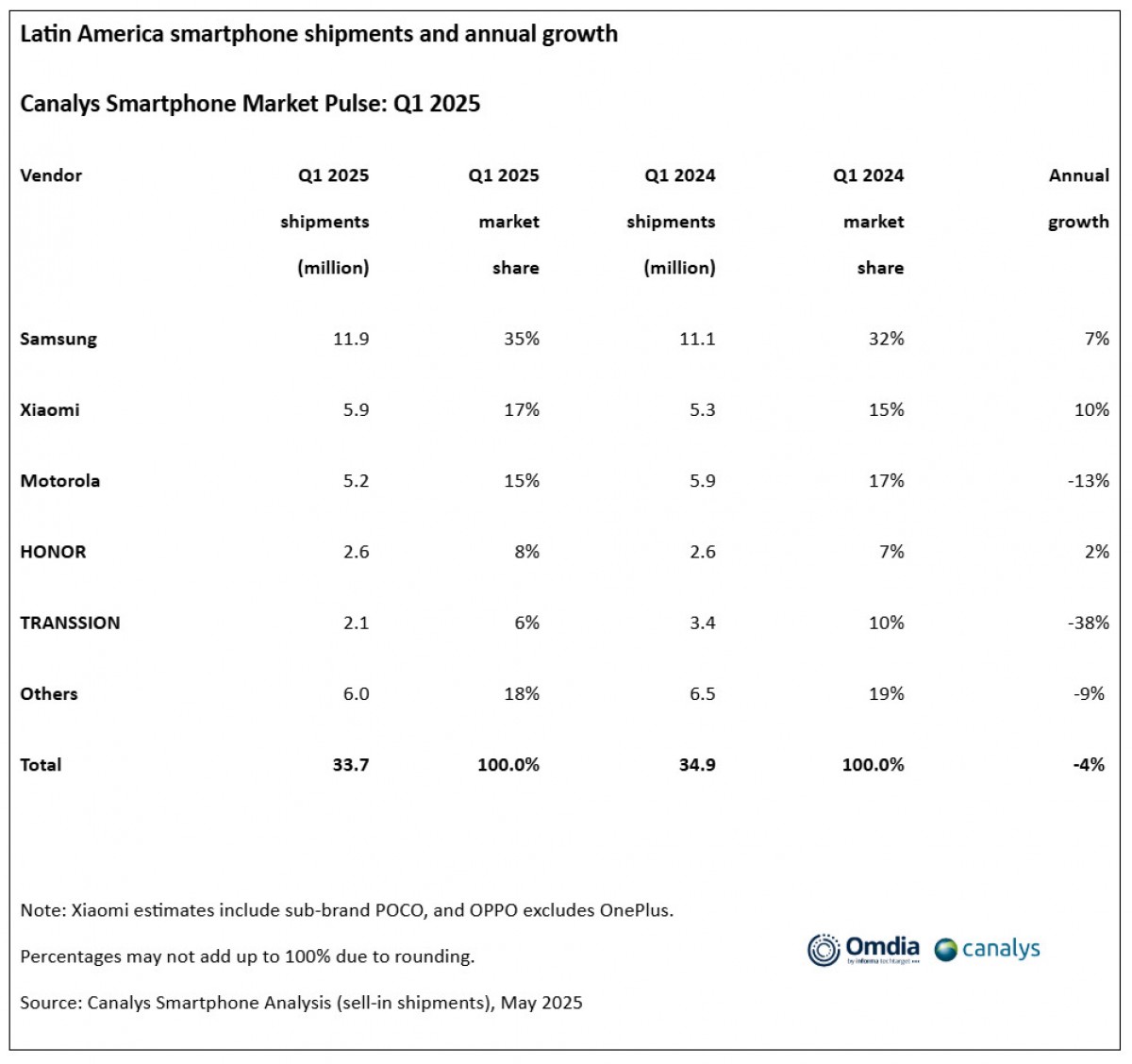

The Latin American smartphone market declined by 4% in Q1 2025 year-on-year, ending a six-quarter growth streak. The region reached 33.7 million shipments, down from 34.9 million last year. Brazil showed a rather modest growth of 3% during the period. Brazil is also the region’s biggest market, accounting for 38% of the total smartphone sales.

Mexico is the second-biggest market, with 22% of the shipments, but sales dipped by 18%. This sharp decline is likely due to increased competition in 2024, which forced aggressive device renewal.

The Central America region ranks third, recording a 7% decline in sales, while Colombia and Peru, fourth and fifth, respectively, also experience declining sales.

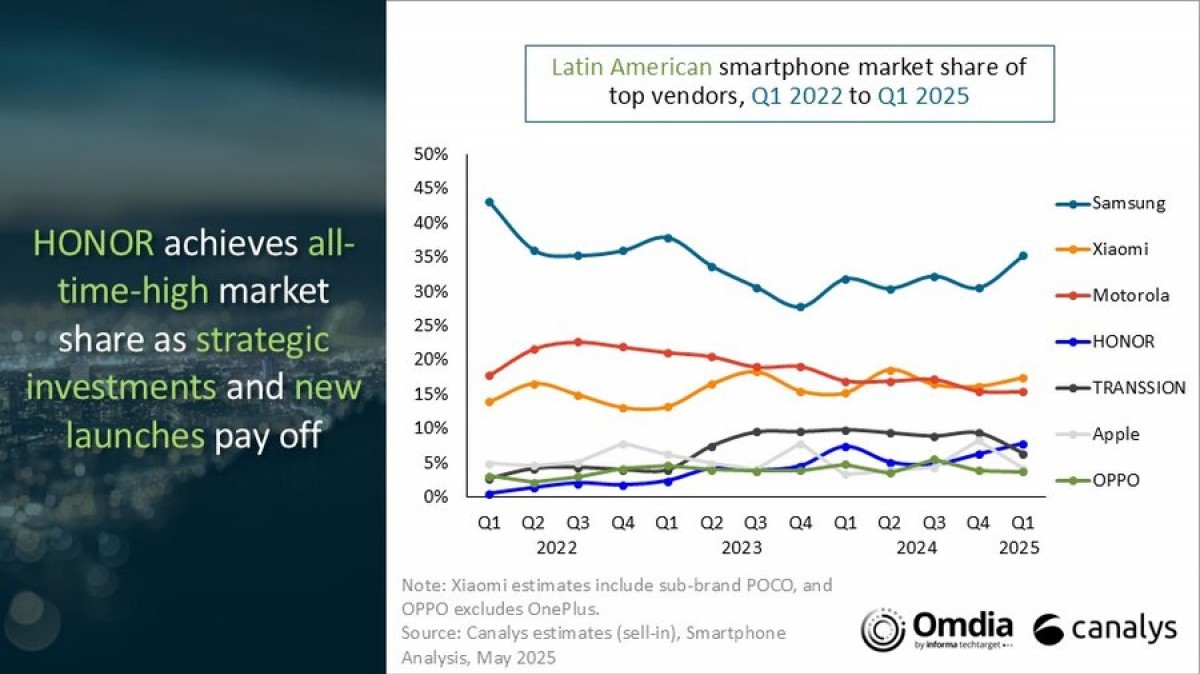

When it comes to brands, Samsung continues to hold the first place while posting a healthy 7% year-on-year growth, mainly driven by its low-end models. The same goes for Xiaomi, which saw an even bigger 10% growth, again mainly due to its affordable Redmi lineup.

Motorola fell to third place and experienced a 13% decline in total sales, while Honor rose to fourth place with 2% more shipments. In contrast, Transsion took the biggest hit with a 38% decline in sales and slipped to fifth place. Analysts think this is due to increased competition and restructuring in channel inventory.

Looking ahead, Canalys projects that the LATAM market will contract by 1% in 2025 due to rising economic uncertainties and fear of tariffs. People are putting off non-essential upgrades, extending the upgrade cycle. As an emerging market, Latin America is strongly influenced by geopolitical and global economic headwinds. For example, the rising USA-China tensions could potentially trigger economic instability and inflation in the region.

Vendors are also being cautious, though. They’ve pulled back on aggressive sales strategies and kept inventories low during Q1 2025, which also affected the market performance in the region.